We Get Results

Powered by

Albuquerque Personal Injury Attorneys

You didn’t expect this. A personal injury can turn your life upside down, but this doesn’t have to be the case with you.

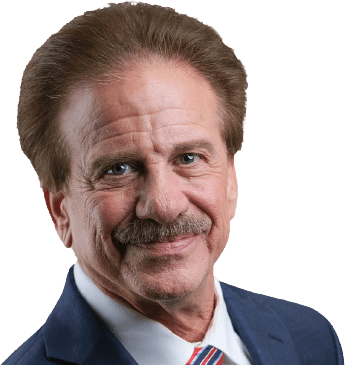

Take the stress out of dealing with your situation by teaming up with Ron Bell Injury Lawyers. We have decades of experience in personal injury law that will get you the compensation you deserve and help you focus on recovery.

Why Choose Ron Bell

Personal injury lawyers are a dime a dozen, so how do you narrow down your choice? Your ideal lawyer will take time to understand your unique challenges and needs while working hard to get you results you deserve.

Ron Bell’s service stands out to clients because, when you work with us, you will:

Get Relief

Personal injury law is complex. Navigating it can be stressful. You can get relief by working with a personal injury lawyer who knows the ropes of the law, cares about your needs, and works hard to help you understand the process.

Receive a free consultation

Few things in this world are free. Our guarantee to you is that your initial consultation is absolutely free with no obligation.

Hold the guilty party responsible

Ron Bell Injury Lawyers is in your corner, ready to fight to get the justice you need to move forward. We can help you achieve the best possible outcome. Whether you require an experienced car accident lawyer, or an attorney for another type of personal injury, we are here to be your voice.

Put New Mexico law at work for you

We have been practicing law in New Mexico for more than three decades. Our wealth of knowledge and experience is here for your benefit.

Strengthen your case

Our team has the know-how to investigate and piece together evidence to secure your case. Report your accident as soon as possible to make sure your case is handled correctly.

Hire a lawyer who cares

You’re more than a case number. At Ron Bell Injury Lawyers, we look out for your best interests. We make sure that you’ve recovered as much as possible before settling your claim.

Schedule your free consultation today

To find out what your case is worth and how we can help you, please fill out our case evaluation form or give us a call at the time most convenient for you.

Who pays for damages?

New Mexico State Law requires you to open a claim with the at-fault driver’s insurance company or to file a personal injury lawsuit and pursue compensation in court. Ron Bell Injury Lawyers is well-versed in New Mexico personal injury law and can help you get reimbursed for medical costs associated with the accident.

Damages may include:

- Ambulance fees

- ER treatments

- Surgical costs

- Hospital stays

- Nursing services

- Medication costs

- Physical therapy and rehabilitation costs

You’re already under enough stress if you’ve been in a recent accident. Don’t leave your representation up to chance and risk suffering financial loss.

Timing is critical when recovering from an injury. If too much time passes between your accident and choosing representation, it can become difficult to build a strong case.

No matter when you decide to call, Ron Bell Injury Lawyers is there. You can reach us around the clock. We are available 24/7. Contact us by phone or online today for your free consultation and learn more about how we can help.

How much time do you have to settle?

When victims delay in seeking legal advice, it’s often a case of too little, too late. According to New Mexico’s statutes of limitations, you have a limited amount of time to seek legal redress for any bodily harm or property damage suffered. Vital evidence that could have helped strengthen your case may be lost.

Report all accidents to your insurance company within 24 hours, and consult with our team as soon as possible.

Practice Areas

You are unique and so is your injury. At Ron Bell Injury Lawyers, we can handle everything regarding your case. We have a great deal of experience in successfully representing clients in a variety of areas. Click below to see how we can help you with your injury.

Learn more

Learn more

Learn more

Learn more

Learn more

Learn more

Learn more

Learn more

Learn more

Personal injury case

Free evaluation

If you’ve experienced a personal injury, you may need help getting on with your life. That’s where we, the Albuquerque Personal Injury Attorneys, come in.

Ron Bell Injury Lawyers are committed to helping you get the justice you deserve. Call us anything or fill out the form below to schedule a free consultation with our team.

Powered By